The United States’s citizenship-based taxation is a thorn in my side.

Having grown multiple businesses from the ground up, it hurts to give my hard-earned profits to the government. Especially since I don’t even live stateside.

Taxes aren’t fun.

But despite the tax implications, I have four compelling reasons to keep my passport:

Obligatory statement: This is not financial nor legal advice. Do your own research.

“Wait, why would you renounce American citizenship?!”

Long story, short – Citizenship-based taxation.

Unlike most countries that tax you if you live there, the U.S. taxes its citizens no matter where they live in the world.

I’ve lived outside of the United States for two years and only been back for a few weekend trips here and there.

Yet I owe the IRS taxes annually.

Many think it’s unfair. Why should you have to pay taxes to a country that you don’t see any benefits from? After all, I’m not driving on any American roads or bridges 🤣

I’m not here to talk hypotheticals. I’m just saying, I have four solid reasons not to renounce my American citizenship…

4 reasons I don’t plan on renouncing my citizenship … yet

1. No second citizenship

First and most importantly, I don’t have a second citizenship.

For context, when you renounce your U.S. citizenship, the government asks with which nationality you’ll replace them. I’d be renouncing my American citizenship for … nothing, which isn’t possible.

I talk about being ungovernable. But you can’t be literally, completely ungoverned 😆

When I finally do have second citizenship elsewhere, I want easy access to the States for business, family and friends, and tourism.

So that second citizenship can’t just be any citizenship, which leads me to my second point…

2. Access to family, friends & business

I grew up in the U.S.A. My mom, brothers, extended family and most of my friends live in the United States.

Last year, my grandpa and grandma died in the U.S. within a few weeks of each other. In that moment, had I not had my American passport, I wouldn’t have been able to drop everything and immediately return home to my family.

I would’ve hated that.

Also, America is still the best place in the world to make money. I believe that.

I have a few clients in the States. Plus I like to return for conferences, meetings, and other events once in awhile.

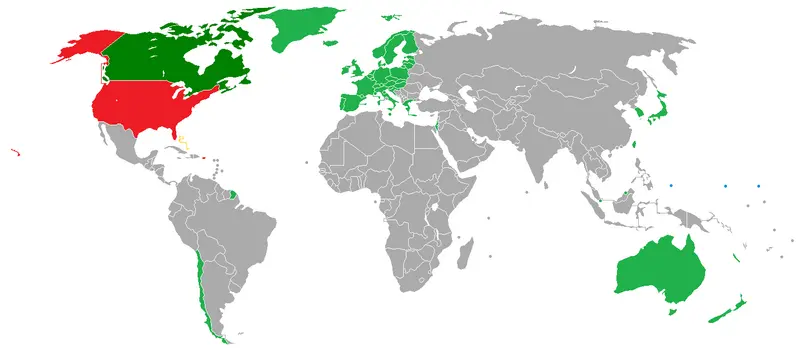

Business, travel and tourism in the U.S. becomes more complicated if you don’t have American citizenship. And especially more complicated if you don’t have citizenship in one of the highlighted Visa Waiver Program countries below.

Tourists from the green countries do not need a visa to enter the United States. They just need to fill out a quick application via the Electronic System for Travel Authorization (ESTA), which grants them 90 days in America.

So without second citizenship in one of these countries, it’s far more complicated and difficult to access the United States. (I know this pain. My girlfriend is Colombian and she cannot enter the United States.)

3. Easier tax rules

Citizenship-based taxation is certainly a curse. Let’s get that out of the way.

But I’ve learned over the last two years that in one way (yes, just one 🙄), it’s also a blessing.

Why?

If a Frenchman (or anyone who doesn’t have citizenship-based taxation) wants to reduce his taxes, he has to spend more than 50% of the year in a low- or no-tax jurisdiction and claim that new jurisdiction as his new tax residency.

I don’t know about you, but I don’t want to spend half of my life in Dubai.

Some countries even require an exit tax or make it extremely difficult to leave their tax grasp.

On the other hand, we Americans automatically owe Uncle Sam under citizenship-based taxation. So we don’t need another tax residency.

We can hop around the world without triggering tax residency (typically 183 out of a 365-day period) in any country.

4. Options for my children

I plan on having kids soon. And like any father, I want them to have the best opportunity to succeed possible.

If I renounce my American citizenship before they’re born, they wouldn’t get the right to claim citizenship – unless they naturalize like every other immigrant.

If I renounce my citizenship after they’re born, they have until their 18th birthday to claim their father’s citizenship by blood.

Giving them the option to claim American citizenship vs. forcing citizenship-based taxation on them (until they renounce) feels like the right thing to do.

Some “passport bros” claim passing down citizenship-based taxation on your kids is equivalent to enslaving them. 😅 I wouldn’t go that far.

But like Kevin Kelly says, “Go with the option that opens up yet more options.”

Of course, as I grow both personally and professionally, my stance will change. I could see myself renouncing later in life when I no longer need access to the country.

But for now, despite the taxes, I’m happy with the emotional and logistical benefits of American citizenship. This is peace of mind for me.

In most cases, the decision to renounce is irreversible and personal. Famous entrepreneur and writer Derek Sivers regrets renouncing.

So don’t take my advice as relevant to your situation. You have your circumstances. I have mine.