When you’re planning to retire abroad, one of your biggest frustrations is watching the IRS continue to take a massive chunk of your hard-earned money. You’ve already paid federal and state taxes (sometimes as high as 13% in California and New York) your entire working life.

But moving abroad allows you the opportunity to legally eliminate your state income tax burden.

SavvyNomad makes this possible by helping you change your domicile to a state with zero income tax and a long history of welcoming Americans from around the country. This is exactly what the Freedom Files founders did before they left the country.

SavvyNomad is designed specifically for people like you who want to keep more of their income while living the overseas life they’ve always dreamed.

Two Simple Steps to Major Tax Savings

American expats need a legal home base and permanent address in the US. Moving abroad does not automatically reduce your tax liability to zero.

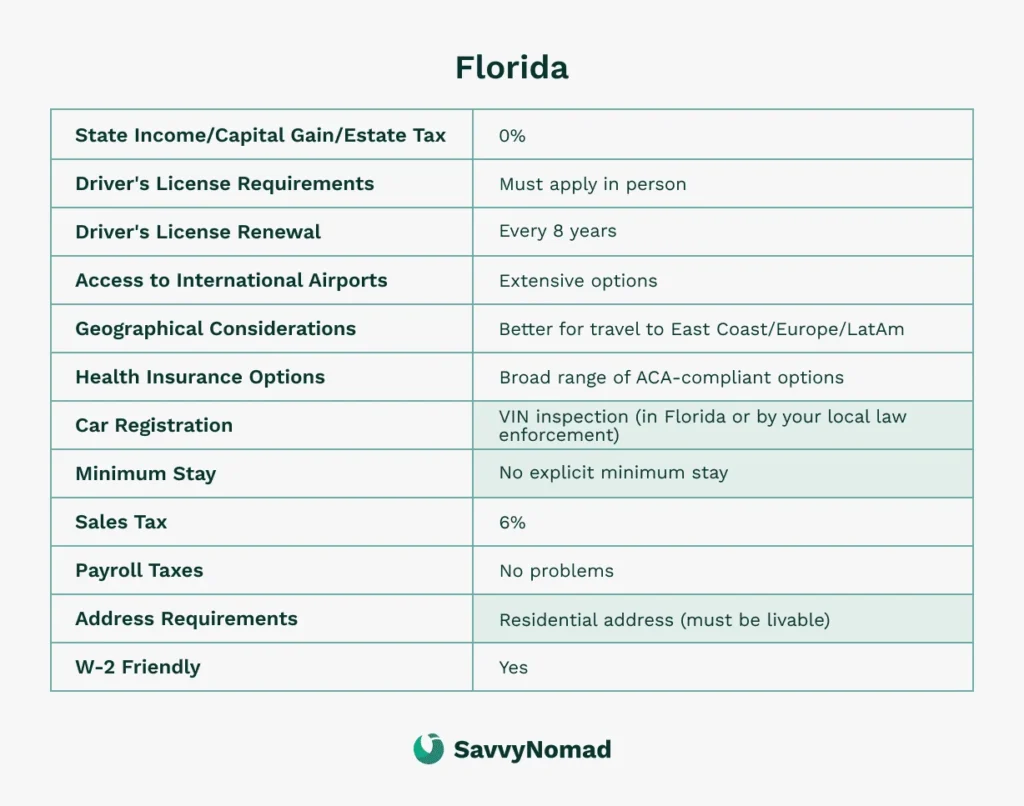

Florida has perfected the system for people like this. In fact, SavvyNomad focuses on Florida because it’s been the go-to choice for expats for decades.

The process is straightforward.

First, SavvyNomad helps you establish strong ties to Florida by providing you with a residential address, handling your mail, and completing all the required paperwork.

Second, you cut ties with your previous high-tax state by updating your driver’s license, voter registration, and financial accounts.

And the residential address they provide isn’t just a mail drop. It’s a legitimate address you can use for your driver’s license, bank accounts, vehicle registration, and tax filing. You can also even use it when applying for residency visas abroad, since many countries require proof of your current address.

Why This Matters for You

State income taxes can eat up 4-21% of your annual income, depending on where you currently live. For an expat with US$100,000 in income, that’s $4,000-$21,000 you’re handing over to a state where you don’t even live anymore.

SavvyNomad bridges that gap.

You get immediate tax savings that you can reinvest or dedicate to your overseas lifestyle, plus you establish a solid US base for when you need to handle business back home. Many of our Freedom Files clients use their Florida residency as part of their visa applications for countries like Spain or Thailand.

You also get the peace of mind knowing you have a reliable address for important documents. When the IRS needs to contact you or when your bank sends a new credit card, you know it’ll reach you no matter where you are.

Florida residency also gives you voting rights in federal elections through absentee ballots, so you can stay engaged in US politics from anywhere. SavvyNomad helps you register to vote and ensures your ballots reach you quickly.

Plus, Florida has no state estate tax, which means more of your wealth passes to your heirs instead of to the state government. This is especially important if you’re planning to leave assets to family members while living abroad.

Simple to Set Up, Even from Abroad

You can complete the entire SavvyNomad process online, which is perfect if you’re already living overseas or planning to leave soon.

Start with a video call with a notary to complete your mail forwarding authorization. No need to find a notary in Lisbon or Bangkok.

Within days, you’ll have your Florida residential address and can update your important accounts. SavvyNomad handles all the state filing fees and paperwork, so you don’t have to navigate the bureaucracy on your own.

The company can even help you schedule your DMV appointment in Sumter County when you’re ready to get your driver’s license. They send people there every single day, so the staff knows exactly what to expect and the process is smooth and fast.

Mail Forwarding

One of the biggest headaches for American expats is managing US mail from abroad.

SavvyNomad has solved this with their mail forwarding service that lets you see what’s arrived, decide what to forward, and shred what you don’t need.

They scan your mail within 24 hours and upload it to your online portal. Whether you’re in Costa Rica or Greece, you can see exactly what arrived and choose to have important documents forwarded internationally.

They charge exactly what they pay for postage. No markup or hidden fees.

Having lived outside the US for a decade, we know how important this service is.

Get Started Before You Go

SavvyNomad recommends starting the process 6-8 weeks before you plan to leave the US, but you can also set everything up after you’re already abroad. It’s just a bit trickier and inconvenient.

The key is establishing your Florida residency as soon as possible to start capturing those tax savings.

The peace of mind alone is worth the investment. You know your US affairs are handled properly, your mail is managed, and you’re maximizing tax savings from day one of your overseas adventure.

To access the Freedom Files’ special SavvyNomad offer and save big on your setup, use our discount code when you sign up. Fill out the form on your screen to access the promotion.