When you retire abroad, one of your biggest worries is what happens when/if you get sick.

Medicare and most other American insurance policies don’t cover you outside the United States. That means if you have a heart attack in Portugal or break your leg in Mexico, you’re left on your own to figure out the best healthcare possible.

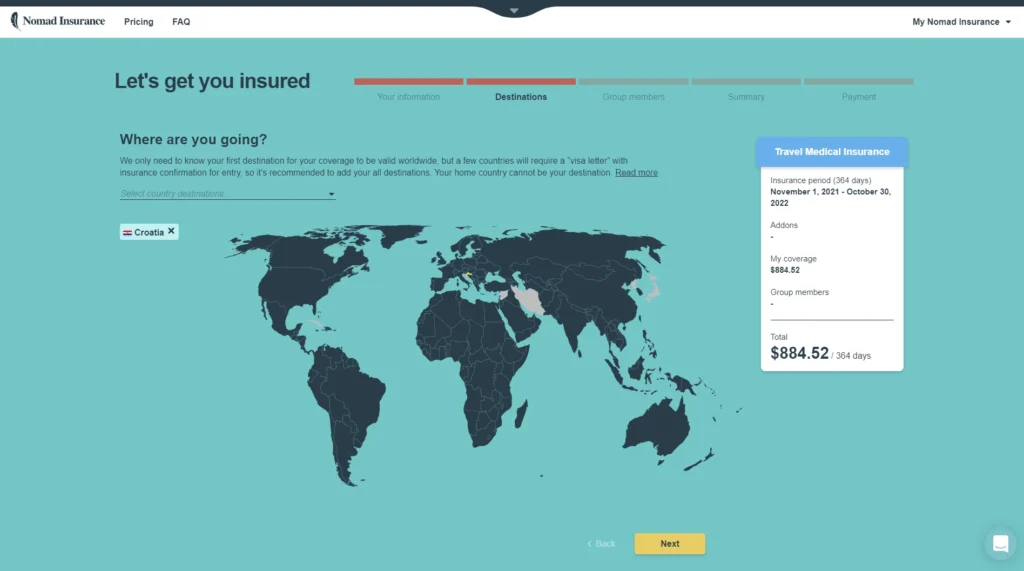

SafetyWing can solve this problem with its health insurance coverage that works in over 180 countries around the world.

Think of SafetyWing as your life raft while living your dream retirement overseas. It’s designed specifically for people like you who want to live abroad without worrying about medical bills.

The company was started by people who actually live the nomad lifestyle, so they understand what you need when you’re far from home.

Two Plans That Make Sense for Retirees

SafetyWing offers two main plans. The Essential plan covers you for unexpected medical problems, hospital stays, and emergencies. It’s perfect if you’re healthy and just want protection from big medical bills.

The Complete plan gives you everything in the Essential plan plus routine checkups, cancer treatment, and mental health support. This one works better if you want full, long-term healthcare coverage like you had back home.

Both plans let you see doctors and go to hospitals without paying huge bills upfront. You can also get your medications covered, which is a big deal when you’re in a foreign country.

The coverage also starts immediately, so you don’t have to wait around hoping nothing bad happens.

Why This Matters for You

Healthcare abroad can be incredibly cheap, but only if you know how to navigate the system.

A doctor visit that costs US$300 in the US might only cost US$50 in Thailand. But without insurance, you could still end up with a US$20,000 hospital bill if something serious happens.

SafetyWing bridges that gap. It’s the perfect solution as you travel the world or as a global insurance plan that’s required by many countries’ immigration authorities (especially in a residency or citizenship application process).

You get the peace of mind knowing you’re covered, plus you can take advantage of the excellent healthcare systems in many countries. Places like Thailand, Malaysia, and Portugal have world-class medical care that often beats what you’d get in the US – obviously, much more affordably too.

Simple to Use

You can file claims online, and SafetyWing usually processes them within a few days. They also have 24/7 customer support, so if you’re in a hospital in Costa Rica at 3am, someone will answer your call.

The company also handles medical evacuations.

This means if you’re in a small town without good medical facilities, they’ll get you to a better hospital. This kind of service can literally save your life, and it’s something you can’t easily arrange on your own from anywhere in the world – as long as you have a phone and cell service.

US Coverage Too

You can visit up to 180 countries and still be covered. You can even visit the US for up to 30 days per year, and SafetyWing still has your back.

This is perfect for those times when you want to see family or handle business back home. You don’t lose your coverage just because you cross borders.

Affordable Protection

The cost of SafetyWing is much less than what you’d pay for comparable coverage in the US. For most retirees, the Essential plan costs around US$56 every four weeks. The Complete plan requires a slightly higher investment (but still reasonable compared to US health insurance).

To access the Freedom Files’ special SafetyWing offer, fill out the form on your screen, so we can send it to you. If you have any questions, let the SafetyWing team or our expat experts know.