In your high-tax “First World” country, you pay 40% of your income to a government that has hyper-inflated the value of your paycheck and funds wasteful social programs you don’t benefit from.

Yay.

If you’re looking to reduce your taxes and afford a more luxurious lifestyle than you have in the developed world, Latin American tax havens are a great destination.

After years of research and countless conversations with LatAm tax experts, here are my top 5 tax havens in Latin America where you can also enjoy that quality of life you seek:

This should not be considered financial, legal, or tax advice. Always talk to an expert before taking any action that may affect your circumstances.

Tax Haven 1: Nicaragua

We start with a country that doesn’t make many “top” lists: Nicaragua.

What do you know about this Central American tax paradise?

No matter what the media tells you about their dictatorship or communist regime, I’ve spoken with Westerners on the ground in the country. And they have nothing but positive things to say about their experience there.

In fact, they try to keep quiet because they don’t want too many gringos relocating to their Nica tax haven.

Nicaragua does not tax foreign-sourced income. Meaning if you have a remote job in your home country or run an online business that’s headquartered outside of Nicaragua, they don’t want to know about it.

Which is how it should be. Right? If you don’t make money in a country, you shouldn’t be taxed there. You may live there, but you don’t serve their citizens or work with their companies.

Fair enough.

Tax Haven 2: Chile (for 3 years)

While it’s not as lenient as Nicaragua’s zero personal income tax on foreign-sourced income tax for life, Chile makes the top 5 list with their 3-year tax holiday for new residents.

Plus, as the only country in Latin America that has visa-free access to the United States, Chile has the strongest passport in the Americas.

So if you become a resident of Chile, you don’t have to pay taxes for 3 years on your foreign-sourced income and can work your way toward the Chilean passport.

However, Chile is not for everyone. There’s a reason it has visa-free access to the United States:

- Chile has some of the highest cost-of-living in Latin America.

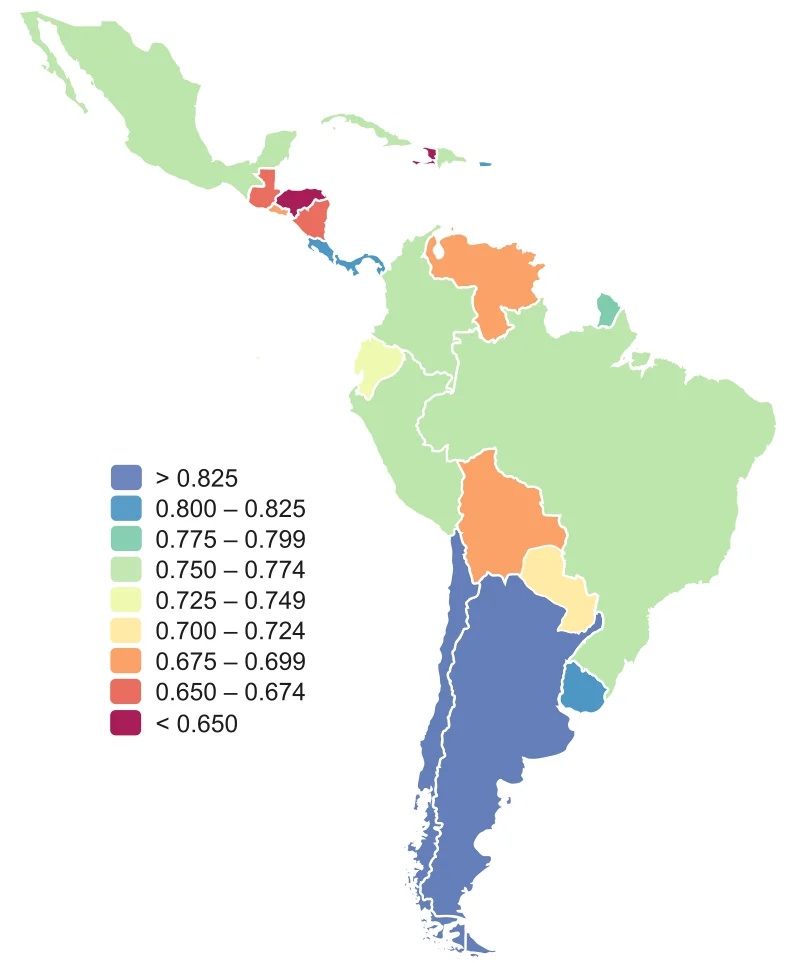

- Chile is the most developed country (HDI measurements below) in Latin America.

- Chile has a reputation for being “boring” and modern.

If those things don’t bother you, by all means – Head to Santiago and don’t pay taxes for 3 years while you wait for citizenship.

Tax Haven 3: Uruguay (for 10 years)

If Chilean life is attractive to you, Uruguay may serve you even better.

This Southern Cone country is called the “Switzerland of South America.” As such, life is appropriately-priced and predictable. The chaos that you may find in neighboring Argentina and Brazil or Mexico and Colombia does not exist in Uruguay.

Personally, the lack of chaos and interesting life doesn’t appeal to me in this stage of my life. But it may be the perfect option for a family or older couple.

And similar to Chile, Uruguay offers new residents a tax holiday of 10 years on any foreign-sourced income – that’s zero tax for a full decade.

Or (yes, there are two options) you may choose their other low-tax strategy of 7% on your personal income every year you’re a tax resident – for life.

Tax Haven 4: Paraguay

If I were not from the United States, Paraguayan residency and tax residency would be an absolute no-brainer.

Paraguay has the most affordable temporary residency (it converts to permanent residency after just two years) in the world. No investment required. No physical presence required.

You just have to prove you have sufficient income to support yourself in Paraguay and pay for legal processing to get temporary residency.

Nice and simple. But why?

Paraguay, like the other countries on this list, does not tax foreign-sourced income. If you earn elsewhere, they say it’s not their business.

Here’s a scenario:

Let’s say you’re from Canada and you get paid $100,000 USD a year. As such, you’re accustomed to a 40% personal income tax in your home country each year. The government steals $40,000 from you every single year.

Brutal.

But you can eliminate personal income tax from your life and you’ll earn back that $40,000 every year. In just 5 years, that’s a $400,000 swing of extra income in your pocket.

That’s sufficient income to retire in several countries around the world. Wild!

So how do you eliminate those taxes? By taking these two steps (seriously, it’s that simple):

- Cut economic ties with Canada — Spend fewer than 6 months a year there, sell your home, stop paying utilities and bills, etc.

- Claim tax residency in Paraguay — Get temporary residency, spend 120 days a year there, create strong economic ties, etc.

IT’S PAY DAY, CANADA!

Tax Haven 5: El Salvador

If you’re a Bitcoiner like me, I hate to break it to you: The Bitcoin haven that most think El Salvador is does not exist. The introduction of the new currency to Salvadoran society has been slow and miscommunicated.

With time, maybe that changes. But there are so many other reasons El Salvador makes this top 5.

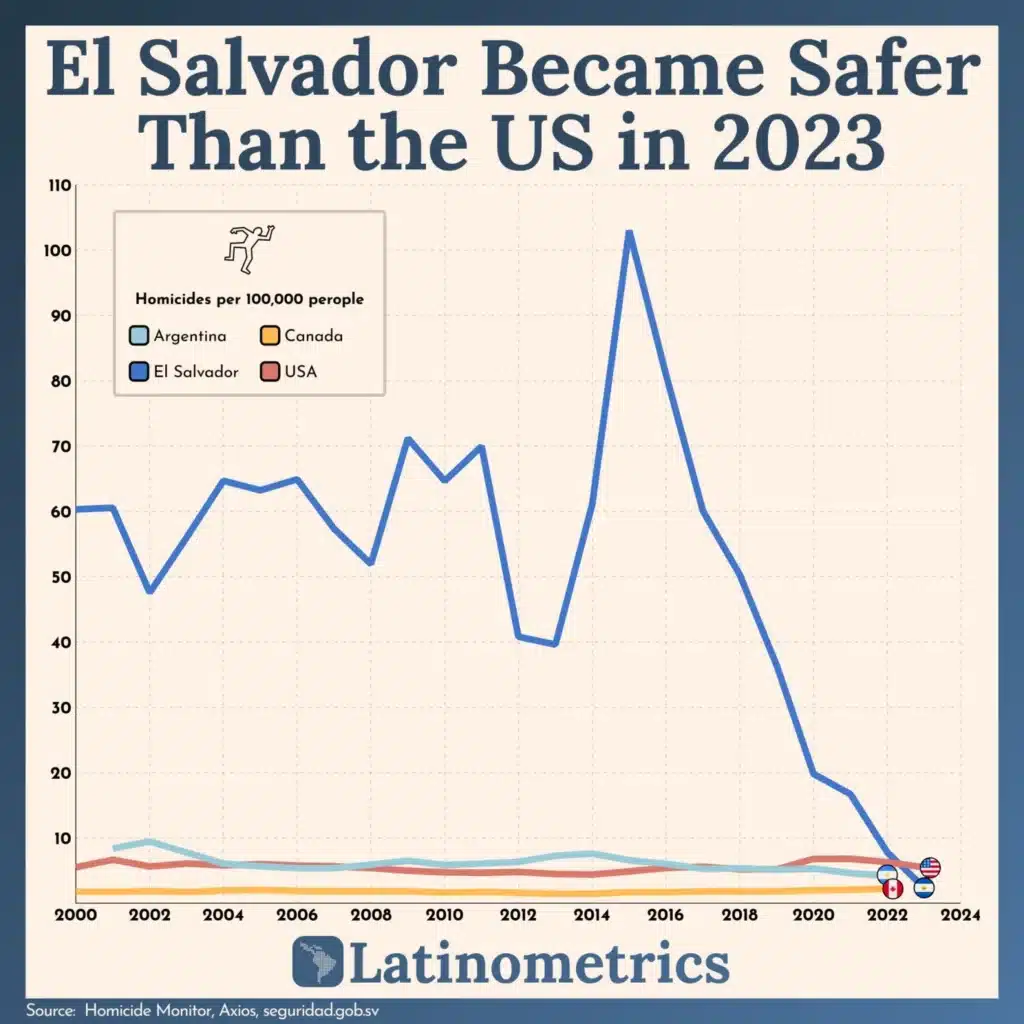

El Salvador has changed its income tax policy to exempt foreign-sourced income. And after suffering more than 100 murders per day per 100,000 citizens in 2015, El Salvador has become one of the safest countries in the Western Hemisphere.

Add these changes (and zero foreign-sourced personal income) to the growing list of recent wins President Nayib Bukele has brought to the Central American country. In fact, he was just re-elected in a landslide victory by 90% of the country.

No wonder!

As long as you have a remote job or online business based in a foreign country, plenty of Latin American countries won’t tax your personal income. It’s one of the most tax-friendly regions in the world.

Where do you have your sights set? Did I cover it in this list?