FYI – This is not financial nor legal advice. This is just my personal experience. Please consult your lawyers, realtors and accountants before taking any action.

So, you want to buy real estate in Colombia or obtain residency in Colombia?

Whether it’s a finca, apartment or home, you really can’t go wrong.

Colombia hosts one of the strongest economies in Latin America. And foreign investment is skyrocketing.

After traveling around Latin America for 18 months, I wanted a home base. I wanted a home in my favorite country in the world. Somewhere to call “my own.” And bonus – somewhere to obtain a residency (and eventual citizenship) outside the United States.

I had fallen in love with the Colombian people and culture. So that’s exactly what I did…

But there are SO many things I would’ve done differently about the homebuying process. Here’s what you should know before investing and the process of doing so:

What to know before investing in Colombia

Residence & visa considerations

If you’re buying a Colombian property solely for investment purposes and have no intention of applying for a visa or residency in the future, then you can skip this section.

Colombia allows foreigners and non-residents to invest in private property. Many countries do not.

In exchange for buying your property, you are eligible to apply for a Migrant (M) investment visa, which is valid for up to 3 years. For more info on this visa’s requirements, check this out.

The most important requirement to apply for the M visa: Your property must be worth more than 350 minimum monthly salaries ($406m COP = $97k USD at the time of this writing).

If you’re interested in renewing your visa and applying for permanent residency, make sure the purchase value of your property is still above the new minimum salary requirement upon renewal. The Colombian government changes their minimum salary annually.

After renewing your M visa and holding it for 5 years, you’re now eligible to apply for the Residency (R) visa, which most countries call permanent residency. And after 5 years of holding residency, you can apply for Colombian citizenship.

Market considerations

I’m not the best resource for Colombian markets and how it’ll fare in the future. Admittedly, my investment was personal and a bit emotional. (My girlfriend is Colombian.)

But you should know that the Colombian real estate market is hot right now. There’s a ton of foreign investment pouring in, and costs are rising. Good news – That likely means your property’s value will also increase in value.

Just five years ago, you could’ve bought a penthouse in Poblado, the wealthiest, most touristy neighborhood in Medellín, for half of what you’d pay today. But still prices remain very low compared to American, Canadian or European markets.

Is it a bubble? Not sure. I think nomadism and a more globalized real estate market is a trend here to stay. But we’ll see.

Currency considerations

Remember COP does not equal USD. Keep an eye on the exchange rate.

Don’t try to time the market because you’ll never be happy with your investment decision. But be aware that the seller cannot accept American dollars if you want to apply for a visa.

So while your investment will surely increase in COP, it may not in American dollars.

This can be a game-changer in terms of what you can afford and how much you stand to gain (or lose) from your investment.

Also, generally speaking, Colombian banks don’t offer mortgages or loans to non-residents. So you most likely have to pay in full for your property.

Cultural considerations

Obviously, as you venture out into the pueblos and hillsides of the Colombian country, you’re not going to get as great access to public resources as you would in a city like Bogotá, Medellín or Cartagena.

So if you’re in the market for a finca, consider the low walkability and occasional electricity outage.

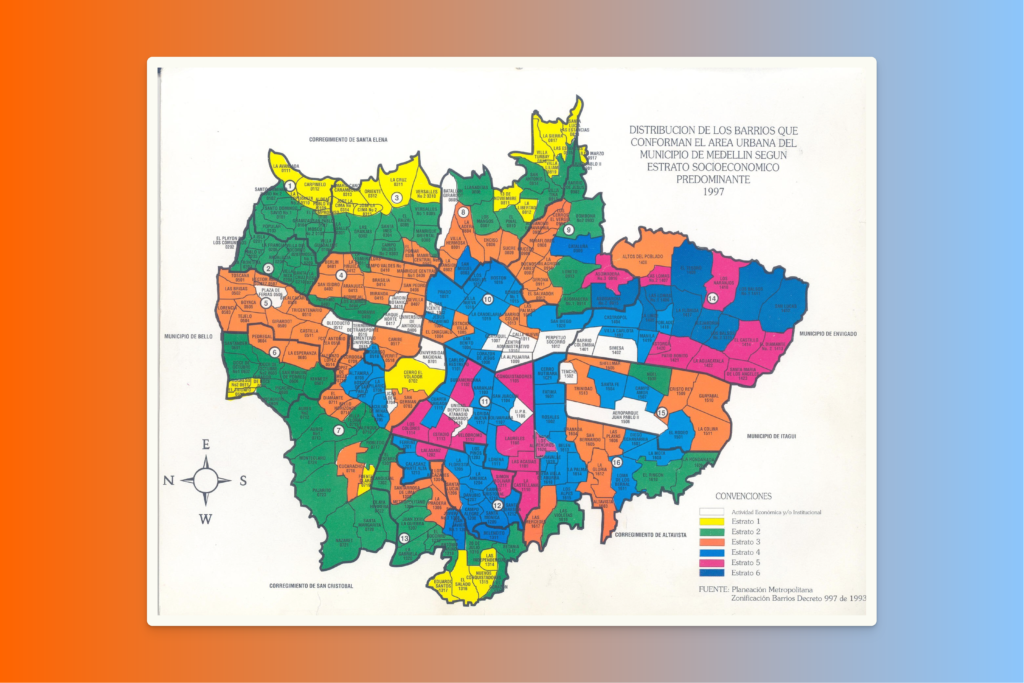

Also, Colombia operates on an estrato system. Each neighborhood in the country is assigned a socioeconomic status from 1 (lowest) to 6 (highest).

Your estrato impacts a ton of different elements from the cost of utilities to the price of the property. Most foreign investors buy in estratos 5 or 6 because of …

- better public resources like good roads, sidewalks, trash pickup, etc.

- better access to schools, medical care, shopping, etc.

- generally wealthier and safer neighborhoods.

Be aware of your neighborhood’s estrato. For reference, the apartment I bought above is estrato 4.

To learn more about my personal experience finding and buying an apartment in Medellín, Colombia, book a 45-minute Freedom consult (not free) with me.

A 6-step guide to buying real estate & getting permanent residency in Colombia

We’ve covered a few things you should consider before buying. Now let’s dive into the actual process of purchasing your property.

Before you start, find an immigration lawyer. A good one will take you through this exact process. Reach out to me over email or DM to get my recommendation.

Note: Again, consult your lawyers, realtors and accountants. Your process may differ from mine.

1. Open a bank account in Colombia

First off, you’re going to need a Colombian bank account. The seller is most likely Colombian and will want their local currency (COP) in exchange for the property.

I recommend getting this sorted a few weeks before you start looking at properties. Do NOT do this without your immigration lawyer’s help.

You have virtually two options:

If you’re applying for the Migrant visa, you absolutely need to open a bank account in Colombia because the transfer of funds is the most important part of the purchase process.

You need to make sure you nationalize the funds 100% correctly for the Colombian Central Bank to approve your purchase as part of your visa application.

The process can be a bit of a hassle, but obviously, it’s essential for the next steps. Prepare yourself for lots of physical paperwork (yes, I know 🙄) and an in-person visit or two to your local bank site.

Also, I’ve heard from others that if you’re trying to transfer cryptocurrency or Bitcoin into the country, it’s exponentially more difficult and you may have to wait months before those funds are officially recognized and you can purchase your home.

2. Find the right property for you

This is where a realtor can really come in handy.

Why? Because househunting in Colombia (and Latin America in general) is more difficult than in the West.

There’s no centralized place to search available properties. No Zillow or RedFin. There’s not even an MLS for accredited realtors and real estate companies. So it’s tough to find both good realtors and a property that fits your needs.

Here are a few places to start your search:

- Metro Cuadrado

- Finca Raíz

- Mercado Libre

- Facebook Marketplace (yes, seriously)

You don’t necessarily need a realtor to buy a property in Colombia.

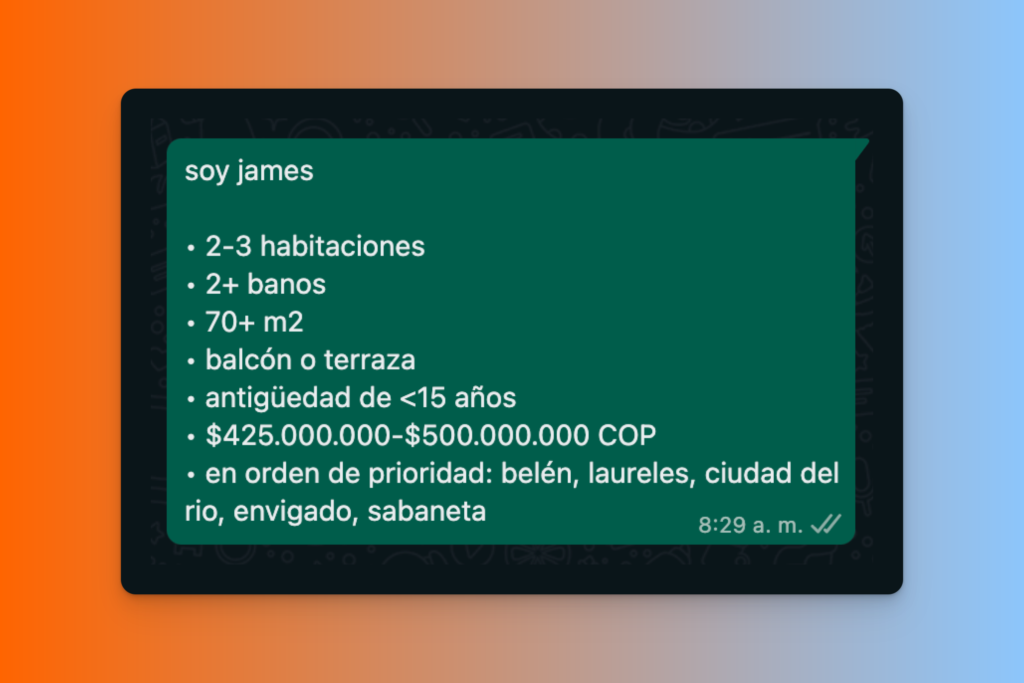

These are the metrics you’ll need to narrow down your search:

- Budget in COP / USD

- of bedrooms

- of bathrooms

- m² / ft²

- Floor

- Antiquity

- Estrato

- Neighborhood, comuna or location

- Administration fee (if apartment)

- Property tax

3. Hire a lawyer

Once you have found your property, it’s time to bring in a real estate lawyer. I have a great contact if you need one.

They’ll …

- draft the purchase agreement,

- complete the title study – required for the visa –,

- and negotiate and guide you through the purchase.

Sure, it’s another small price to pay.

But a piece of advice: Don’t trust – Verify. At any point during this investment process, you could be scammed. By the seller. By the realtor. By the lawyer.

Having a highly trained lawyer who’s completed this process before is invaluable.

And by the way, the best ones aren’t always the most expensive.

During my purchase process, I had the consul of both a real estate lawyer and an immigration lawyer – both of whom I’d highly recommend. The immigration lawyer had experience in real estate investment because of the visa context. So he was able to support me in the purchase.

Another voice to confirm all my decisions. Very helpful!

4. Pay for your property

Now it’s time to make it official.

Remember back in step one you opened your bank account, but you didn’t deposit your funds.

This step takes a day or two to transfer over the full amount to the seller of your property. So consider that if you’re in a time crunch.

Here’s how it works:

- You transfer the total purchase amount in dollars (no more or less) to an associated bank

- They transfer your money to the Colombian bank

- The Colombian bank confirms your transfer via phone call

- You negotiate the dollar → peso nationalization of your funds

- Your funds are ready to be sent to the seller

Also, you have a couple payment options:

- You can either pay the full amount upfront.

- Or if your home or apartment isn’t complete yet, you can pay half upfront and delay the other half until it’s delivered to you. This is also when you’ll sign the deed. (This is what I did.)

Once you’ve paid for your property in full, you’re the proud owner of Colombian real estate. Congratulations!

5. Apply for the migrant visa (optional)

With the transaction complete, you can apply for your investment M visa if you’d like to stay in the country past the 180 days you’re allowed on the standard tourist visa (90 days with a 90-day extension).

Just remember, you can only apply for the visa AFTER the property transaction is complete. But once you have your deed, you’re good to go.

You’ll need two special documents from your real estate investment process:

- Escritura or deed

- Colombian Central Bank’s certificate of the nationalization of your funds

Reach out to me for a fantastic recommendation of an immigration lawyer. I’ve worked with him through two processes now, and I’m very happy with his services.

6. Renew your visa until you have permanent residency (optional)

Once your visa application is accepted, you’ll have between 1 and 3 years in the country. Yippee!

If you’d like permanent residency (”Residency visa” in Colombia) after 5 years, you’ll have to renew your visa once, twice or even three times.

To renew your visa, the purchase value of your property must still be above the 350 minimum salaries threshold mentioned above. It’s $406 million COP in 2023 but will continue to rise.

So pay attention to how the Colombian government increases the minimum wage and changes immigration rules.

Maintain your residency for 5 more years, and you can apply for Colombian citizenship.

3 last-minute tips

- Learn Spanish — This one is pretty self-explanatory. None of this process will be in English. Not the legal paperwork. Not the bank account opening. Not the visa application. So knowing the native language will help you tremendously. Can’t understate this.

- Find good lawyers, realtors & accountants — The best don’t always charge the most. So don’t necessarily pay top dime and expect you’ll be taken care of. Scamming is prevalent. Instead of searching online for great legal help, go through friends or email / DM me for my trusted recommendations.

- Have someone manage the process for you — For me, that someone was my girlfriend (she’s Colombian). I had her manage my realtor and lawyers, as well as relay all tasks to me. She also led the process and prevented me from getting “gringo priced.” Yes unfortunately, if you show up to an apartment showing and you have white skin and don’t speak Spanish, expect to pay more for your apartment than locals will.

There are a lot of topics I didn’t discuss in this blog because I’m neither a lawyer or expert in Colombian real estate. But I think it’s important for people to hear my raw first-hand experience.

If you want to hear more about it, you can book a 45-minute consult with me to break down each step piece-by-piece.